DJIA

SPX

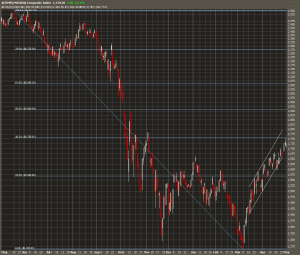

Nasdaq Composite

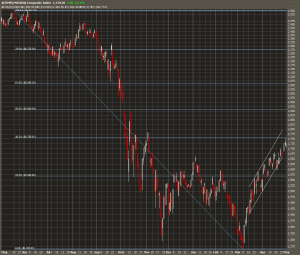

XLF

The real stress test has already happened, but these results won’t be publicly recognized. For the last few weeks, the major indices have tested upside resistance multiple times tempting the bears to get back into the game. The remaining uncertainty in the market is significantly less than at the beginning of the year, and the Government’s Stress Test and auto industry turmoil account for a large percentage of the overall market volatility. The results of the Stress Test have been delayed three days, to May 7th. The delay stems from disagreement between the banks and the regulators, and while only delaying the inevitable, is perceived as a positive. There is only one reason the banks would disagree with regulators over the results, because the regulators made a mistake, miscalculated or estimated incorrectly. If the regulators were to overestimate, the banks would never raise attention to it. The disagreement has positive market implications, particularly because most, if not all, negative news has been priced in. This week’s volume was below average, but this is to be expected. Smart money is either already long, or they are awaiting the results of the Stress Test so they can jump into the “healthy” banks. The bears had plenty of opportunities to take this market lower, but failed to succeed, even in the light of a worse than expected GDP.

The first chart is the Dow Jones Industrial Average over the last 20 years, monthly. The Fibonacci retracements suggest important resistance at 8240. Closing above 8240 resistance at the end of May would imply the market has its sights set on the next level, 9650. At the end of May, when the markets have closed above the 8240 level, the uptrend march will continue. I can see the DJIA testing 10,000 during the summer, but do not expect this to last. Expect the DJIA to retrace all the way back to the 8240 level after touching 10,000. This retracement would be extremely healthy, and would establish a base, or support, on top of current resistance. Establishing support on top of previous resistance has bullish implications, and is exactly what each of the major indices is currently doing.

The second chart is of the S&P 500 over the last 10 years, monthly. The Fibonacci retracements again suggest we are approaching important resistance levels, 880. Closing above 880 for May implies 1014 is next. Again, after touching this level, I expect a retracement to 880. The third chart is of the Nasdaq Composite over the last year, daily. No surprises here, the Nasdaq is also nearing important resistance at 1760. Closing above 1760 for the end of a day would imply 1900. However, I expect the Nasdaq to fill the gap at 1950 before retracing. Depending on the relative strength of the market at this time, I do not necessarily expect the Nasdaq to retrace as significantly as the DJIA or SPX. The fourth chart is the XLF Financial SPDR over the last year, daily. Fibonacci retracements are deliberately not drawn here. Over the last month, the XLF has gapped higher and begun to consolidate. This consolidation is similar to what the indices are doing, except the XLF’s next move is contingent on the results of the Stress Test.

As I mentioned already, these results will eliminate a lot of the uncertainty surrounding the financial sector, and will likely be the necessary catalyst to lift this market higher. It is not a coincidence that the markets appear to be searching for a catalyst, especially since reasons for the market to trade lower have not caused any significant decline. Much of the negative news regarding the banks and any forced capital increases has already been priced in. Citigroup and Bank of America, 2 of the 19 banks preparing to receive results of the Stress Test next week, have been shorted heavily. Rumors turned fact concerning additional capital has hit both Citigroup and Bank of America hard, but most analyst do not expect significantly negative remarks from the Government. Citigroup has already announced the conversion of preferred shares to common at the conversion price of $3.25. The short interest in Citigroup is about 23%, and any relatively good news will cause a huge squeeze. I expect to see Citigroup double before expiration of the June option contracts. The open interest for the June $5 calls is over 1.7 million. The derivative markets are quiet indicators of what’s to come.

Markets do not like uncertainty, and when the banking and auto industry issues have been resolved, expect a continuation of this bull market rally. The three largest contributors to the recent market decline was housing, banking and the auto industry. The housing issues were resolved some time ago when the Government took control of Freddie Mac and Fannie Mae. However, it took until a few weeks ago to empirically support a housing bottom. The recovery of the banking crisis began with the failure of Bear Stearns, showed signs of improvement with the consolidations of Merrill Lynch into Bank of America and Wachovia into Wells Fargo, government intervention with AIG, and the collapse of Lehman Brothers. Thursday’s Stress Test results will conclude the banking industry’s roller coaster ride, and mark the beginning of the financial recovery. The finalization of the Chrysler/Fiat deal and the restructuring of General Motors will consummate this entire financial crisis. Although it is clear that the auto industry was not initially involved in this crisis, the threat of systemic risk implied by the collapse of the industry exacerbated fear and volatility in the markets. As each of these issues are put further and further in the past, less overall market uncertainty and volatility will exist. This directly implies steady growth, in my opinion, similar to the growth seen in the 90’s. Low volatility and steady growth are characteristic of secular bull markets.